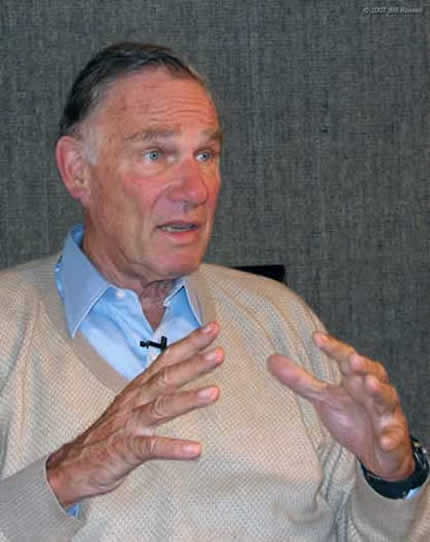

Corporations now are so powerful they threaten both democracy and capitalism itself says, Robert A.G. Monks. This true capitalist-insider is the world’s leading shareholder activist and author of Corpocracy. The U.S. government is so dominated by CEOs and Business Roundtable companies, he says, we’ve corporatized even our most fundamental decisions as citizens – when we will kill and risk being killed.

Mr. Monks passionately believes restoring a balance in the U.S. starts with a simple but vital legal notion -- “trust”, as central to our economic and political system as it is to our society, he says – paired with shareholder activism. For too long, investors in a position of trust passively – or actively – have permitted out-of-control CEOs and Business Roundtable companies to act in their own self-interest at the expense of us all.

“The majority of shares of American companies are owned in trust for a hundred million Americans. (About two-thirds of the public outstanding investments are held by banks, mutual funds and pension funds, trustees all.) The legal notion of a trust is quite simply stated. You appoint me a trustee of Paula. When I accept that trust, I owe Paula an absolutely overpowering obligation, uniquely and solely, to take care of her affairs. I cannot take any step in my own interest that is contrary to Paula’s interest.

“Yet, the notion of ‘trust’ has been superceded by an economic notion: cost-effectiveness, a doctrine in economics. Economics has a beguiling characteristic that if you suspend disbelief and assume you can make a number out of values, you can put them into formula, run them into computers and out with a good answer. Well, wrong! All the important questions – things like ‘Is it the right thing to do? On balance, is it fair?’ -- are not susceptible of being quantified. Can a trust be ‘cost-effective’? It has nothing to do with being cost-effective!

“And now, there are courts that have said in a sense, ‘Obey the law if it’s cost-effective.’ Having ‘cost-effective economics’ dominate the very very necessary soul of trust has gotten us where we are and we have to take it back.”

How? “You don’t need any new laws, any new bureaucracy or any new taxes!” He points out how the Security and Exchange Commission (mutual funds), the Department of Labor (pension funds) and the Federal Reserve (bank trusts) already are responsible for requiring trusts to act on behalf of their beneficiaries, and therefore on behalf of the larger society.

“If I’m going to be a good trustee for a pensioner who has 20 more years to work, I’m not doing the job if I just make him money. I have to run the trust property so that he retires into a clean world, into a law abiding world, into a civil world. So I have a fiduciary duty that you can describe quite accurately -- I have the obligation to manage the assets of the trust so that they are sustainable.

“Unless and until we get the full spectrum of ownership participation, the owner agenda will necessarily be suspect and the utility of involved ownership as a mechanism to produce a holistic capitalism will not be realized.”

Is there a role for the citizens who are currently shut out of the process?

“The people who run corporations are not bad people, it’s just they make up rules that are most in their self-interests. It’s up to us to get those rules changed, and you can, if you start to convince the trustees that they must be responsive to their beneficiaries. What can you do? The mind boggles! Go to any organization of which you’re a member, there are probably four or five groups you’re associated with -- the university you attended, churches of which you’re a member. Talk to the Trustees. Find out about the endowment. Who runs it? They can go to the people who run corporations and say, ‘Do something about this!’”